Collections that go beyond simple automation.

Collections that go beyond simple automation.

While TrueAccord automates digital outreach, we are built for real-time payment tracking, dispute resolution, and collections strategies. FinanceOps gives you full control — you’re not just automating, but actually improving your recovery rates.

While TrueAccord automates digital outreach, we are built for real-time payment tracking, dispute resolution, and collections strategies. FinanceOps gives you full control — you’re not just automating, but actually improving your recovery rates.

Two-way interactive communication

AI-powered forecasting & analytics

Built-in smart payment processing

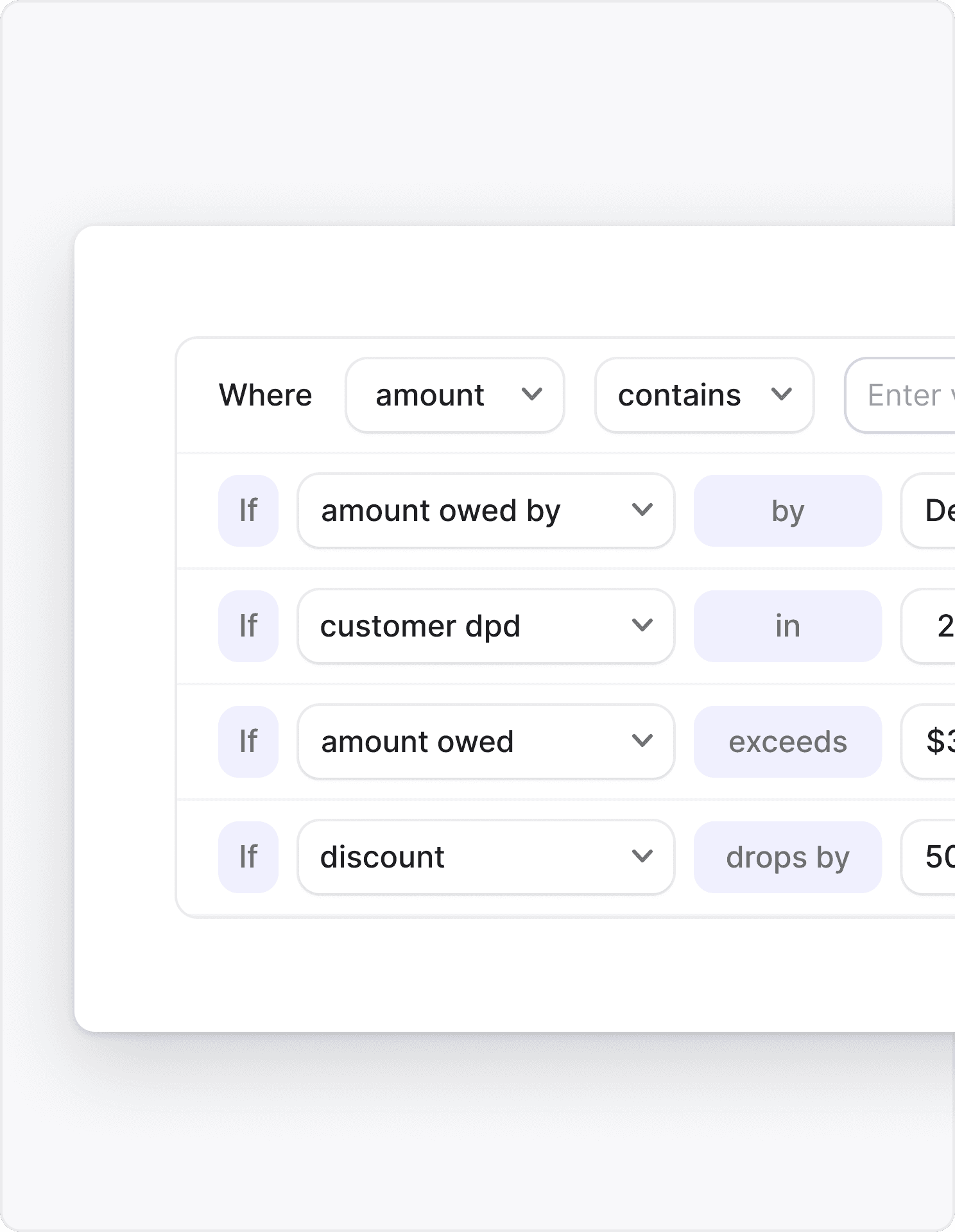

Automated dispute resolution

Real-time teleprompting

Schedule a demo

Fill the form and we will have someone reach out to you

Join companies transforming collections and optimizing costs

Join companies transforming collections and optimizing costs

Unmatched ROI with FinanceOps.

Unmatched ROI with FinanceOps.

Experience better recovery rate accuracy, and improved results compared to competitors.

Experience better recovery rate accuracy, and improved results compared to competitors.

Cut costs with automation

Automate financial tasks, reduce manual work, and increase team productivity.

Maximize accuracy

Improve accuracy, and avoid costly mistakes with more efficient processes.

Optimize cash flow.

Accelerate collections, and enhance cash flow without manual intervention.

Improved collections, lower costs, happier customers — built for your success

$+

Collected per Dollar Spent

$+

Collected per Dollar Spent

$

Amount Collected per message sent

$

Amount Collected per message sent

K+

Messages sent

K+

Messages sent

FEATURES

What are TrueAccord's limitations

See how FinanceOps and TrueAccord compare

FEATURES

What are TrueAccord's limitations

See how FinanceOps and TrueAccord compare

Payment Processing

No payment processing

TrueAccord nudges customers to pay, but doesn’t handle payments directly. FinanceOps streamlines payments with built-in processing and reconciliation.

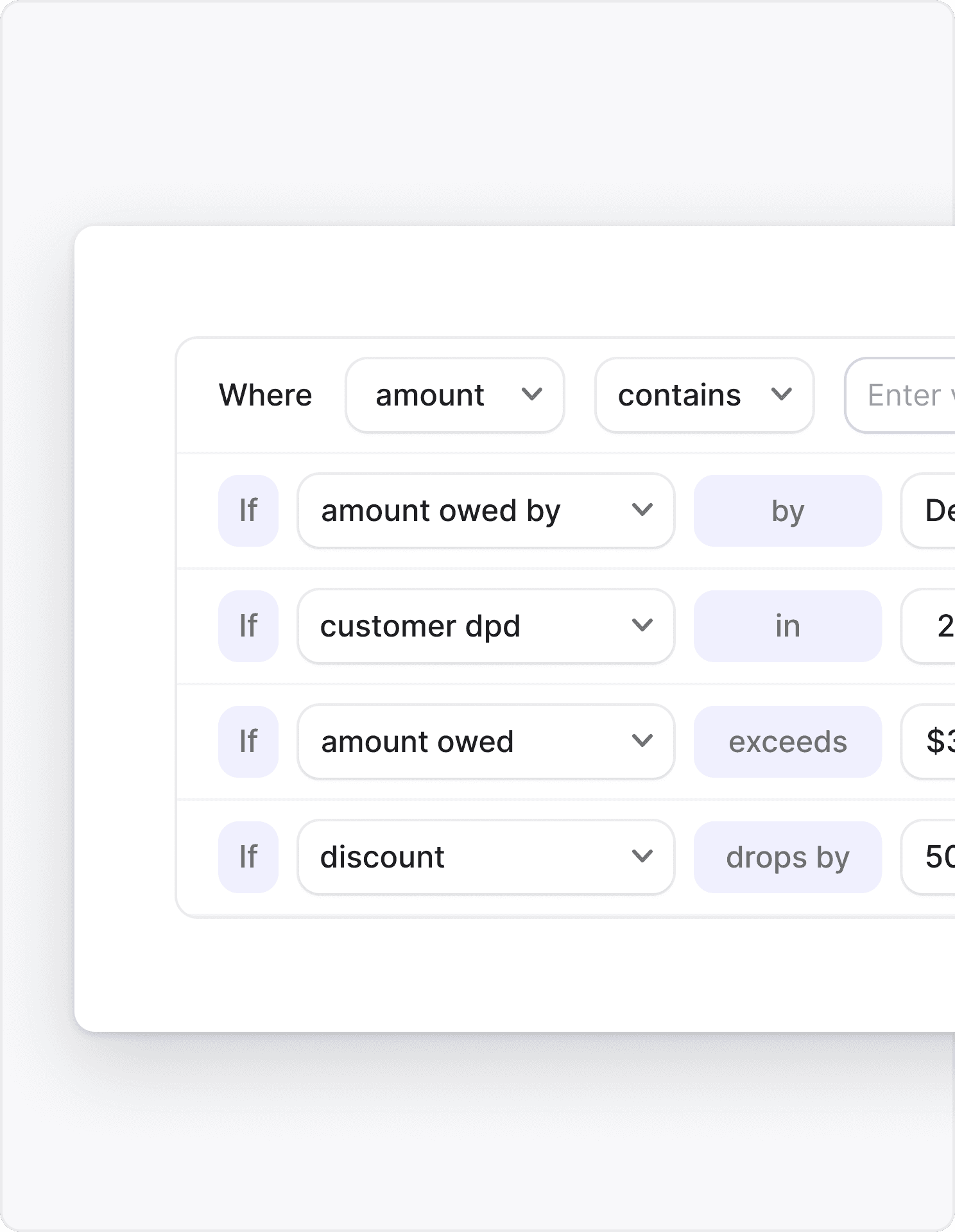

Dispute Resolution

No built-in dispute resolution

FinanceOps automatically flags, categorizes, and resolves disputes. Spend less time chasing paperwork.

FinanceOps automatically flags, categorizes, and resolves disputes. Spend less time chasing paperwork.

Call Summary

Limited forecasting & insights

TrueAccord tracks outreach success, but FinanceOps predicts payment behavior and collection success to keep your cash flow healthy.

AI Calling

One-way automation only

TrueAccord sends automated reminders, but there’s no real-time, two-way communication to resolve disputes or negotiate payments.

Cost

Higher costs, fewer features

TrueAccord charges for automation, but lacks end-to-end collections management. FinanceOps delivers automation, payments, and AI, all at a lower cost.

FEATURES

FEATURES

What are TrueAccords' limitations

See how FinanceOps and True Accord compare

Payment Processing

No payment processing

TrueAccord nudges customers to pay, but doesn’t handle payments directly. FinanceOps streamlines payments with built-in processing and reconciliation.

Dispute Resolution

No built-in dispute resolution

FinanceOps automatically flags, categorizes, and resolves disputes. Spend less time chasing paperwork.

FinanceOps automatically flags, categorizes, and resolves disputes. Spend less time chasing paperwork.

Call Summary

Limited forecasting & insights

TrueAccord tracks outreach success, but FinanceOps predicts payment behavior and collection success to keep your cash flow healthy.

AI Calling

One-way automation only

TrueAccord sends automated reminders, but there’s no real-time, two-way communication to resolve disputes or negotiate payments.

Cost

Higher costs, fewer features

TrueAccord charges for automation, but lacks end-to-end collections management. FinanceOps delivers automation, payments, and AI, all at a lower cost.

Got Questions? We have got the answers

We will have someone from our team reach out to you!

What is FinanceOps used for?

FinanceOps is a collections management platform that helps businesses get paid faster, resolve disputes, and forecast cash flow—without all the manual work.

Who should use FinanceOps?

If you’re in collections, finance, operations, or healthcare, and tired of chasing payments manually, FinanceOps is for you.

Can I integrate FinanceOps with my existing tools?

Yes! FinanceOps integrates with CRM, ERP, and payment systems to make collections seamless.

Is there any plan I can try before committing?

Of course! Our Launch Plan lets you explore AI-led collections with no lock-in period or minimum credits.

What is FinanceOps used for?

FinanceOps is a collections management platform that helps businesses get paid faster, resolve disputes, and forecast cash flow—without all the manual work.

Who should use FinanceOps?

If you’re in collections, finance, operations, or healthcare, and tired of chasing payments manually, FinanceOps is for you.

Can I integrate FinanceOps with my existing tools?

Yes! FinanceOps integrates with CRM, ERP, and payment systems to make collections seamless.

Is there any plan I can try before committing?

Of course! Our Launch Plan lets you explore AI-led collections with no lock-in period or minimum credits.

Get more results with AI

TrueAccord gives you analytics. FinanceOps gives you results.

See how FinanceOps compares with TrueAccord

Get more results with AI

TrueAccord gives you analytics. FinanceOps gives you results.

See how FinanceOps compares with TrueAccord

Get more results with AI

TrueAccord gives you analytics. FinanceOps gives you results.

See how FinanceOps compares with TrueAccord

TrueAccord

AI-powered digital collections, mainly outbound messaging

AI-powered digital collections, mainly outbound messaging

AI-powered digital collections, mainly outbound messaging

No built-in A/B testing

No built-in A/B testing

No built-in A/B testing

One-way digital messaging, limited real-time interaction

One-way digital messaging, limited real-time interaction

One-way digital messaging, limited real-time interaction

AI-driven messaging, less customization for businesses

AI-driven messaging, less customization for businesses

AI-driven messaging, less customization for businesses

Predefined workflows with AI-driven outreach

Predefined workflows with AI-driven outreach

Predefined workflows with AI-driven outreach

AI segments debtors but lacks deep cohort insights

AI segments debtors but lacks deep cohort insights

AI segments debtors but lacks deep cohort insights

Predicts repayment likelihood, lacks detailed forecasting

Predicts repayment likelihood, lacks detailed forecasting

Predicts repayment likelihood, lacks detailed forecasting

No O2C automation, focuses on debt recovery

No O2C automation, focuses on debt recovery

No O2C automation, focuses on debt recovery

No dispute management

No dispute management

No dispute management

AI assists in customer interactions, limited agent support

AI assists in customer interactions, limited agent support

AI assists in customer interactions, limited agent support

Basic recovery tracking, lacks granular forecasting

Basic recovery tracking, lacks granular forecasting

Basic recovery tracking, lacks granular forecasting

Relies on third-party integrations

Relies on third-party integrations

Relies on third-party integrations

Standardized AI-driven approach, less flexibility

Standardized AI-driven approach, less flexibility

Standardized AI-driven approach, less flexibility

Compliance-focused, but primarily for debt collection

Compliance-focused, but primarily for debt collection

Compliance-focused, but primarily for debt collection

Revenue-share model based on recovered payments

Revenue-share model based on recovered payments

Revenue-share model based on recovered payments

No Launch Plan available

No Launch Plan available

No Launch Plan available

Performance & volume-based fees

Performance & volume-based fees

Performance & volume-based fees

Companies focused solely on debt recovery

Companies focused solely on debt recovery

Companies focused solely on debt recovery

FinanceOps AI

AI-driven outreach, dispute resolution & payment processing

AI-driven outreach, dispute resolution & payment processing

AI-driven outreach, dispute resolution & payment processing

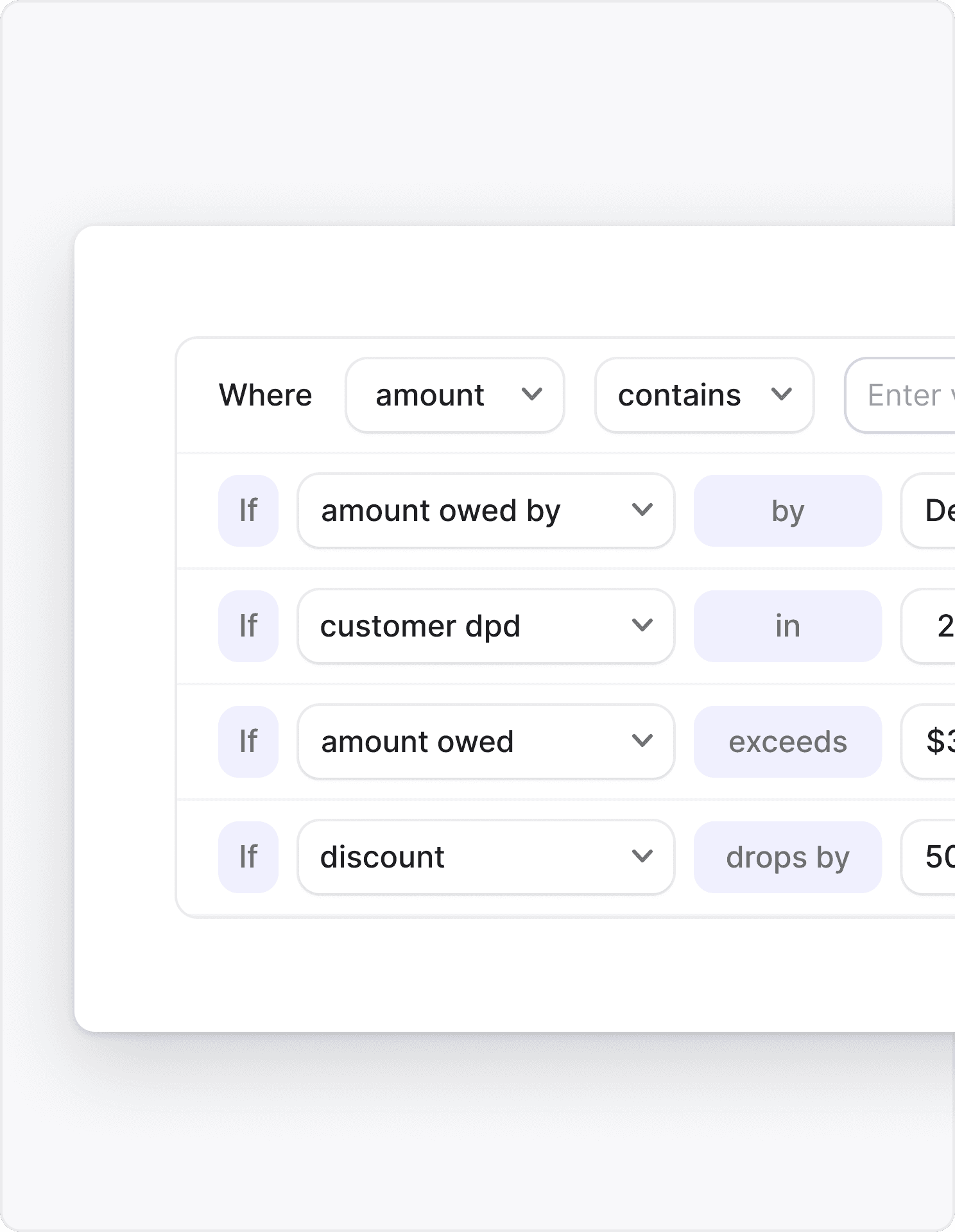

A/B testing for optimized collections strategies

A/B testing for optimized collections strategies

A/B testing for optimized collections strategies

Real-time engagement via SMS, email, WhatsApp & calls

Real-time engagement via SMS, email, WhatsApp & calls

Real-time engagement via SMS, email, WhatsApp & calls

Full control over AI-driven messaging and engagement strategies

Full control over AI-driven messaging and engagement strategies

Full control over AI-driven messaging and engagement strategies

Automates collections, disputes, reminders & escalations

Automates collections, disputes, reminders & escalations

Automates collections, disputes, reminders & escalations

Tracks recovery patterns & optimizes outreach

Tracks recovery patterns & optimizes outreach

Tracks recovery patterns & optimizes outreach

AI-driven predictive analytics for recovery & cash flow

AI-driven predictive analytics for recovery & cash flow

AI-driven predictive analytics for recovery & cash flow

End-to-end automation for invoicing & risk analysis

End-to-end automation for invoicing & risk analysis

End-to-end automation for invoicing & risk analysis

AI categorizes & resolves disputes automatically

AI categorizes & resolves disputes automatically

AI categorizes & resolves disputes automatically

Automates workflows & payment reminders

Automates workflows & payment reminders

Automates workflows & payment reminders

Cash flow insights & recovery analytics

Cash flow insights & recovery analytics

Cash flow insights & recovery analytics

Built-in payments & reconciliation

Built-in payments & reconciliation

Built-in payments & reconciliation

Fully customizable workflows

Fully customizable workflows

Fully customizable workflows

Automated FDCPA compliance across channels

Automated FDCPA compliance across channels

Automated FDCPA compliance across channels

Usage-based (pay for what you use

Usage-based (pay for what you use

Usage-based (pay for what you use

Yes, we offer a Launch Plan

Yes, we offer a Launch Plan

Yes, we offer a Launch Plan

No hidden fees

No hidden fees

No hidden fees

Best for teams looking for end-to-end automation

Best for teams looking for end-to-end automation

Best for teams looking for end-to-end automation

Boost collections with FinanceOps

Got Questions? We have got the answers

We will have someone from our team reach out to you!

What is FinanceOps used for?

FinanceOps is a collections management platform that helps businesses get paid faster, resolve disputes, and forecast cash flow—without all the manual work.

Who should use FinanceOps?

If you’re in collections, finance, operations, or healthcare, and tired of chasing payments manually, FinanceOps is for you.

Can I integrate FinanceOps with my existing tools?

Yes! FinanceOps integrates with CRM, ERP, and payment systems to make collections seamless.

Is there any plan I can try before committing?

Of course! Our Launch Plan lets you explore AI-led collections with no lock-in period or minimum credits.

What is FinanceOps used for?

FinanceOps is a collections management platform that helps businesses get paid faster, resolve disputes, and forecast cash flow—without all the manual work.

Who should use FinanceOps?

If you’re in collections, finance, operations, or healthcare, and tired of chasing payments manually, FinanceOps is for you.

Can I integrate FinanceOps with my existing tools?

Yes! FinanceOps integrates with CRM, ERP, and payment systems to make collections seamless.

Is there any plan I can try before committing?

Of course! Our Launch Plan lets you explore AI-led collections with no lock-in period or minimum credits.

FEATURES

What are TrueAccord’s limitations

Why just remind customers when you can actually get paid?

Calling

One-way automation only

TrueAccord sends automated reminders, but there’s no real-time, two-way communication to resolve disputes or negotiate payments

Get a demo

Dispute Resolution

No built-in dispute resolution

FinanceOps automatically flags, categorizes, and resolves disputes. Spend less time chasing paperwork.

Get a demo

Payment Processing

No payment processing

TrueAccord nudges customers to pay, but doesn’t handle payments directly. FinanceOps streamlines payments with built-in processing and reconciliation.

Get a demo

Call Summary

Limited cash flow forecasting

TrueAccord tracks outreach success, but FinanceOps predicts payment behavior and collection success to keep your cash flow healthy.

Get a demo

Cost

Higher costs, fewer features

TrueAccord charges for automation, but lacks end-to-end collections management. FinanceOps delivers automation, payments, and AI, all at a lower cost.

Get a demo

Got Questions? We have got the answers

We will have someone from our team reach out to you!

What is FinanceOps used for?

FinanceOps is a collections management platform that helps businesses get paid faster, resolve disputes, and forecast cash flow—without all the manual work.

Who should use FinanceOps?

If you’re in collections, finance, operations, or healthcare, and tired of chasing payments manually, FinanceOps is for you.

Can I integrate FinanceOps with my existing tools?

Yes! FinanceOps integrates with CRM, ERP, and payment systems to make collections seamless.

Is there any plan I can try before committing?

Of course! Our Launch Plan lets you explore AI-led collections with no lock-in period or minimum credits.