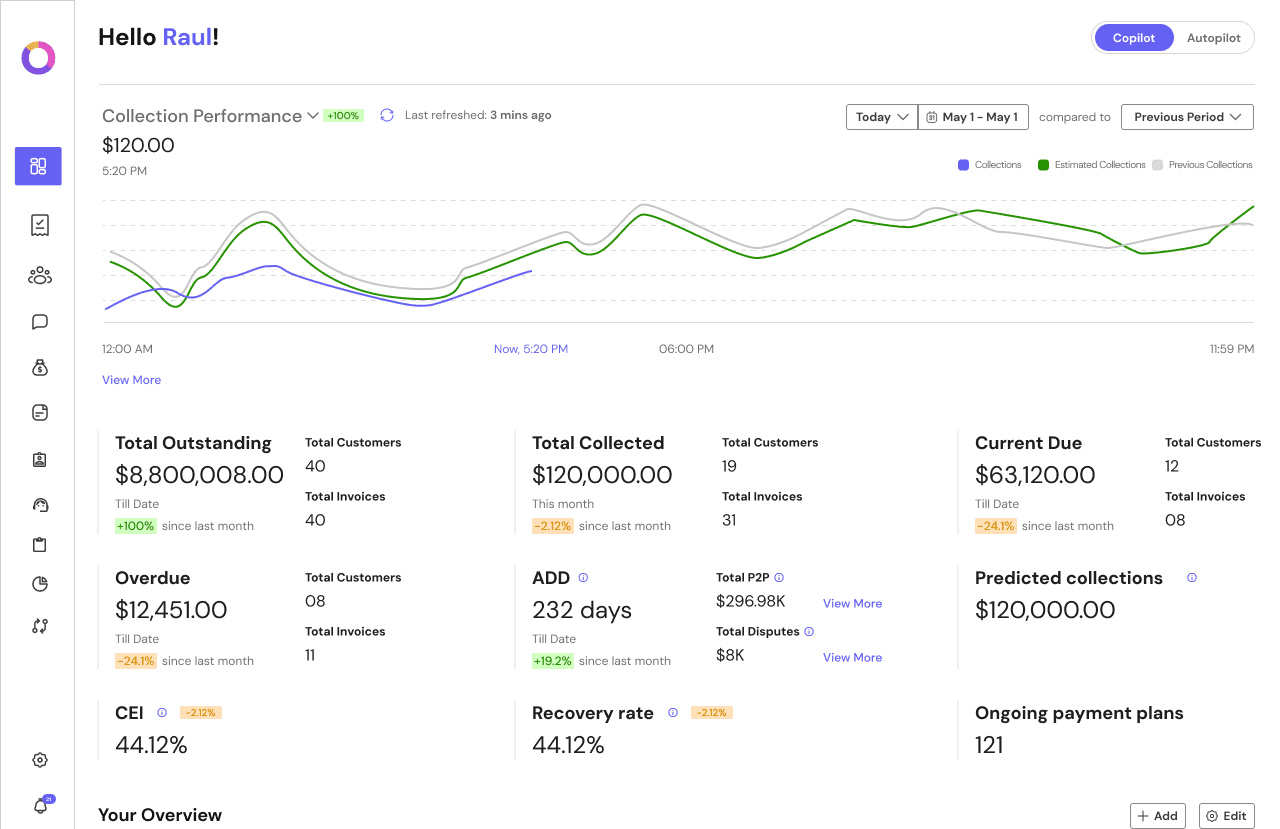

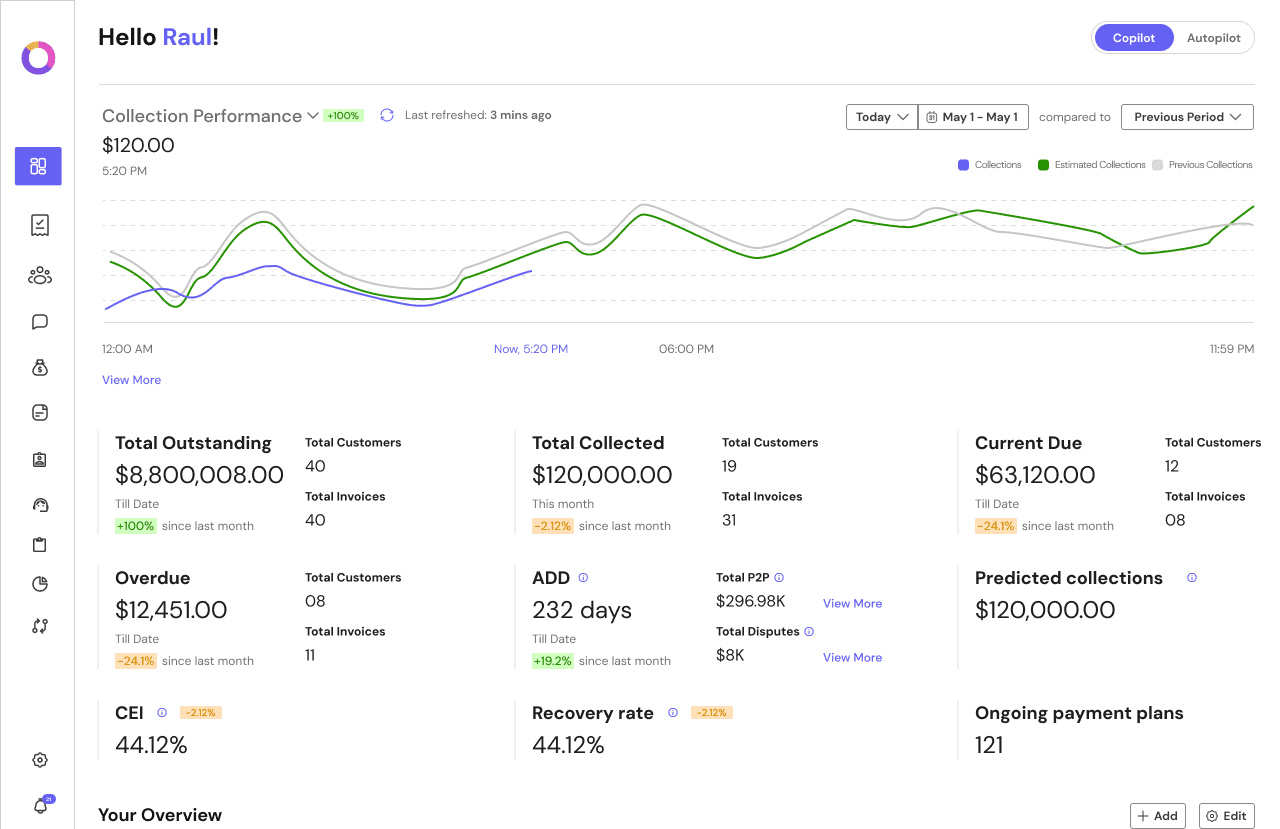

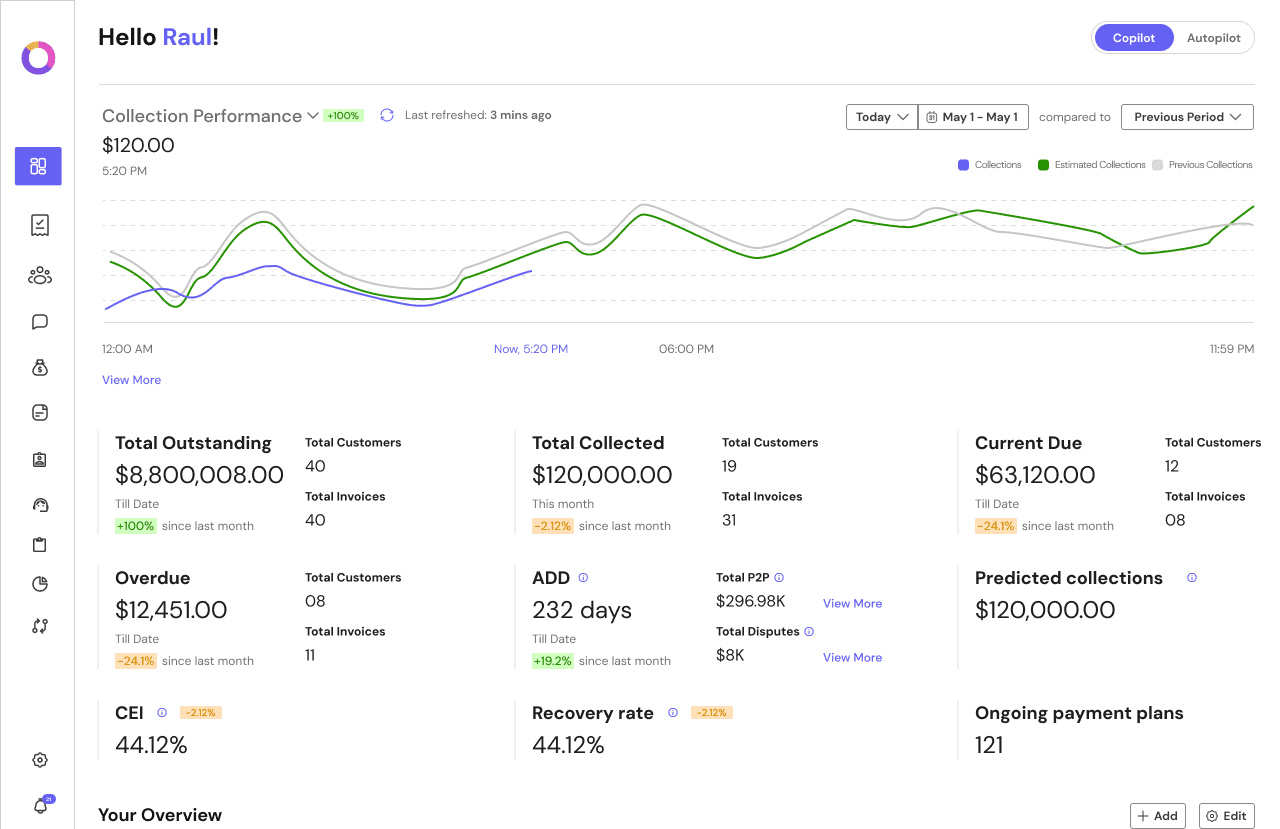

The Smarter Way to Collect — With Zero Extra Hires

The Smarter Way to Collect — With Zero Extra Hires

The Smarter Way to Collect — With Zero Extra Hires

AutoPilot handles follow-ups, disputes, and timing — hands-free.

AutoPilot handles follow-ups, disputes, and timing — hands-free.

AutoPilot handles follow-ups, disputes, and timing — hands-free.

AI-Driven AutoPilot for Smarter, Hands-Free Collections

Autopilot is your always-on collections automation engine — seamless, smart, and powered by debt recovery software that works while you sleep.

Best Time to Contact

Engage customers when they’re most likely to respond, based on behavioral trends and historical patterns.

Invoice Management

Automate invoice creation, tracking, and reconciliation for faster payments

Live Sentiment Analysis

Adjust tone and content in real time using AI-powered emotional cues from interactions.

Customer Characteristics

Surface insights like ease of collectability, payment history, and risk level.

AI-Driven AutoPilot for Smarter, Hands-Free Collections

Autopilot is your always-on collections automation engine — seamless, smart, and powered by debt recovery software that works while you sleep.

Best Time to Contact

Engage customers when they’re most likely to respond, based on behavioral trends and historical patterns.

Invoice Management

Automate invoice creation, tracking, and reconciliation for faster payments

Live Sentiment Analysis

Adjust tone and content in real time using AI-powered emotional cues from interactions.

Customer Characteristics

Surface insights like ease of collectability, payment history, and risk level.

AI-Driven AutoPilot for Smarter, Hands-Free Collections

Autopilot is your always-on collections automation engine — seamless, smart, and powered by debt recovery software that works while you sleep.

Best Time to Contact

Engage customers when they’re most likely to respond, based on behavioral trends and historical patterns.

Invoice Management

Automate invoice creation, tracking, and reconciliation for faster payments

Live Sentiment Analysis

Adjust tone and content in real time using AI-powered emotional cues from interactions.

Customer Characteristics

Surface insights like ease of collectability, payment history, and risk level.

Predictive Outreach that works

Predictive Outreach that works

Predictive Outreach that works

Engage customers when they’re most likely to respond — with messaging tailored to their mindset and behavior.

Engage customers when they’re most likely to respond — with messaging tailored to their mindset and behavior.

Engage customers when they’re most likely to respond — with messaging tailored to their mindset and behavior.

Best Time to Contact

Our system predicts optimal contact windows so you reach customers when they’re most likely to respond.

Analyze historical engagement patterns by time and day

Automate outreach scheduling based on likelihood to pay

Customize reminders for each customer’s behavior

Increase contact rates without extra manual effort

..And more

Best Time to Contact

Our system predicts optimal contact windows so you reach customers when they’re most likely to respond.

Analyze historical engagement patterns by time and day

Automate outreach scheduling based on likelihood to pay

Customize reminders for each customer’s behavior

Increase contact rates without extra manual effort

..And more

Best Time to Contact

Our system predicts optimal contact windows so you reach customers when they’re most likely to respond.

Analyze historical engagement patterns by time and day

Automate outreach scheduling based on likelihood to pay

Customize reminders for each customer’s behavior

Increase contact rates without extra manual effort

..And more

Live Sentiment Analysis

Gauge emotional tone on calls or messages and adjust your strategy instantly.

Detect positive, neutral, or negative sentiment mid-conversation

Prompt agents with tone-adjusted scripts in real time

Escalate sensitive cases automatically to supervisors

Log sentiment trends to refine future communication strategies

And more

Live Sentiment Analysis

Gauge emotional tone on calls or messages and adjust your strategy instantly.

Detect positive, neutral, or negative sentiment mid-conversation

Prompt agents with tone-adjusted scripts in real time

Escalate sensitive cases automatically to supervisors

Log sentiment trends to refine future communication strategies

And more

Live Sentiment Analysis

Gauge emotional tone on calls or messages and adjust your strategy instantly.

Detect positive, neutral, or negative sentiment mid-conversation

Prompt agents with tone-adjusted scripts in real time

Escalate sensitive cases automatically to supervisors

Log sentiment trends to refine future communication strategies

And more

Customer Characteristics

Know who you're reaching — before you reach out.

Segment customers by behavior and risk to tailor your collections strategy.

Profile accounts by payment history, balance size, and risk level

Predict ease of collectability for each customer

Automatically assign accounts to the best-fit workflow

Prioritize high-likelihood accounts for faster recovery

..And more

Customer Characteristics

Know who you're reaching — before you reach out.

Segment customers by behavior and risk to tailor your collections strategy.

Profile accounts by payment history, balance size, and risk level

Predict ease of collectability for each customer

Automatically assign accounts to the best-fit workflow

Prioritize high-likelihood accounts for faster recovery

..And more

Customer Characteristics

Know who you're reaching — before you reach out.

Segment customers by behavior and risk to tailor your collections strategy.

Profile accounts by payment history, balance size, and risk level

Predict ease of collectability for each customer

Automatically assign accounts to the best-fit workflow

Prioritize high-likelihood accounts for faster recovery

..And more

Results That Speak for Themselves

Results That Speak for Themselves

Results That Speak for Themselves

Financeops delivers measurable outcomes that traditional collections can’t match — all with zero friction and full transparency.

Financeops delivers measurable outcomes that traditional collections can’t match — all with zero friction and full transparency.

Financeops delivers measurable outcomes that traditional collections can’t match — all with zero friction and full transparency.

Customers

Amount Collected Yearly

Hours Saved

Frequently Asked Questions

Find quick answers about our services. Reach out to us directly for more information!

What is FinanceOps Autopilot?

Autopilot is our always-on, fully automated collections engine. It handles customer follow-ups, payment reminders, and invoice management with zero manual intervention — perfect for businesses that want recovery to happen while they sleep.

How does Autopilot use AI for debt collections?

Autopilot uses AI to analyze customer behavior, payment risk, and optimal contact timing. It sends personalized reminders through email, SMS, or WhatsApp — all based on smart segmentation and performance data.

Can I customize Autopilot workflows?

Yes. You can define rules based on invoice age, payment history, or sentiment. From escalation paths to tone of message, every aspect is configurable to match your brand and collections strategy.

Does Autopilot work with my existing accounting tools?

Yes. FinanceOps Autopilot integrates with tools like QuickBooks, NetSuite, Xero, and Sage — syncing invoices, payments, and customer data in real time.

How does Autopilot improve recovery rates?

By contacting customers at the best time, using the right tone, and never missing a follow-up, Autopilot improves engagement and increases recovery rates by up to 40% — especially for small-balance or long-tail debt portfolios.

What is FinanceOps Autopilot?

Autopilot is our always-on, fully automated collections engine. It handles customer follow-ups, payment reminders, and invoice management with zero manual intervention — perfect for businesses that want recovery to happen while they sleep.

How does Autopilot use AI for debt collections?

Autopilot uses AI to analyze customer behavior, payment risk, and optimal contact timing. It sends personalized reminders through email, SMS, or WhatsApp — all based on smart segmentation and performance data.

Can I customize Autopilot workflows?

Yes. You can define rules based on invoice age, payment history, or sentiment. From escalation paths to tone of message, every aspect is configurable to match your brand and collections strategy.

Does Autopilot work with my existing accounting tools?

Yes. FinanceOps Autopilot integrates with tools like QuickBooks, NetSuite, Xero, and Sage — syncing invoices, payments, and customer data in real time.

How does Autopilot improve recovery rates?

By contacting customers at the best time, using the right tone, and never missing a follow-up, Autopilot improves engagement and increases recovery rates by up to 40% — especially for small-balance or long-tail debt portfolios.

What is FinanceOps Autopilot?

Autopilot is our always-on, fully automated collections engine. It handles customer follow-ups, payment reminders, and invoice management with zero manual intervention — perfect for businesses that want recovery to happen while they sleep.

How does Autopilot use AI for debt collections?

Autopilot uses AI to analyze customer behavior, payment risk, and optimal contact timing. It sends personalized reminders through email, SMS, or WhatsApp — all based on smart segmentation and performance data.

Can I customize Autopilot workflows?

Yes. You can define rules based on invoice age, payment history, or sentiment. From escalation paths to tone of message, every aspect is configurable to match your brand and collections strategy.

Does Autopilot work with my existing accounting tools?

Yes. FinanceOps Autopilot integrates with tools like QuickBooks, NetSuite, Xero, and Sage — syncing invoices, payments, and customer data in real time.

How does Autopilot improve recovery rates?

By contacting customers at the best time, using the right tone, and never missing a follow-up, Autopilot improves engagement and increases recovery rates by up to 40% — especially for small-balance or long-tail debt portfolios.

Transform Your Financial Processes

Join thousands of businesses already saving time and money with FinanceOps

Transform Your Financial Processes

Join thousands of businesses already saving time and money with FinanceOps

Transform Your Financial Processes